Overview

China’s interest in RISC-V technology has recently caught global attention with compelling reporting from Reuters and The New York Times as well as in-depth analysis from the Jamestown Foundation.

The role of China’s “Big Tech” in Beijing’s RISC-V approach is an interesting – and revealing – feature of how China approaches opportunities in global technological exchange and competition. Tencent serves as an instructive example. Tencent is a core player in China’s tech landscape and Beijing’s answer to America’s dominance of the hyper-scaler ecosystem globally. Tencent’s positioning and broad base of downstream IT-fueled lines of business benefit from engagement with the global open source semiconductor ecosystem.

Tencent’s efforts in this space are closely aligned with the Chinese government’s broader ambition to localize the semiconductor value chain; Tencent’s efforts play out in partnership with known military-civil fusion players, like Huawei, and official government research bodies, like the Chinese Academy of Sciences. Tencent’s cloud business is itself a proud champion of China’s military-civil fusion strategy. The alignment of government, enterprise, and MCF lines of effort underscores the risk of by China’s tech players usurping global technological opportunities, like RISC-V, and

Background

The Tencent founding story tracks with the early internet champions who came to prominence with the widespread adoption of online activity. Tencent raised venture capital from China’s leading investors in the late 1990s and grew from a media and online services platform to become the largest video game publisher in the world today. Its global reach and scale is further exemplified by its WeChat platform and the 1 billion monthly active users that make it one of the most widespread “super apps” in the world. Its business scope ranges from social media to entertainment to banking and financial services.

As one of China’s largest tech companies, Tencent has found itself in the crosshairs of US-China geopolitical tension over the past five years. Tencent lobbies the US government to mitigate the negative effects of regulation against China’s tech players. In China, Tencent has a history of working closely with the government that dates back to its founding and includes contributions that support the efficacy of Beijing’s Great Firewall. More recently, that collaboration has included support of domestic propaganda efforts and similar efforts to develop foreign influencers. At the same time, the Chinese government has targeted Tencent in its own “techlash” aimed at reigning in the private sector. For example, the Chinese government recently launched a crackdown on online gaming that immediately registered as multi-billion dollar impact to Tencent’s market capitalization.

Open Source Chips

Chinese sources are explicit about the opportunity diagnosed with open source chip development, like that of the RISC-V architecture. And driven by market demand for near-term applications across segments like automotive and Internet of Things, China’s RISC-V ecosystem has expanded rapidly. Half of the world’s 10 billion cores using RISC-V come from China, and hundreds of Chinese companies are reported to be actively developing with the RISC-V instruction set. 12 of the 22 senior members of the RISC-V International Foundation are Chinese companies, including China’s Big Tech champions like Alibaba, Huawei, and ZTE.

Tencent followed a path laid out by its Baidu and Alibaba peers with regard to open source chips when it joined the RISC-V International Foundation as a senior member. Tencent’s support of RISC-V and China’s aim to leverage the technology as a leapfrog opportunity predates its membership in the International Foundation. Chinese sources see tremendous promise in Tencent’s adoption of RISC-V for the broader Chinese semiconductor industry. Tencent has made strides in the development of their own chipsets through the work of their Penglai Lab – the leader of which serves on the RISC-V technical steering committee. That provides a significant amount of commercial scale and technical expertise to China’s RISC-V program. And given Tencent’s diverse businesses and volume of chip purchasing – for applications ranging from gaming to new energy vehicles – a massive boon of China’s indigenization of the semiconductor value chain could result simply from Tencent procuring from its own production vice importing foreign chips.

Military-Civil Fusion Ties

Tencent has a varied history of propaganda, influence operations, and cybersecurity activities that align with Beijing’s national strategy of military-civil fusion. More specific to Tencent’s advanced chip and data server operations, Tencent’s cloud platform business explicitly declares in promotional materials that the company plans to “consciously shoulder the political responsibility of national defense mobilization and construction in the new era.”

The company celebrates its successes as a platform for the development of military-civil fusion applications that use big data technology, including provincial and national defense mobilization, civil air defense construction, and military recruitment.

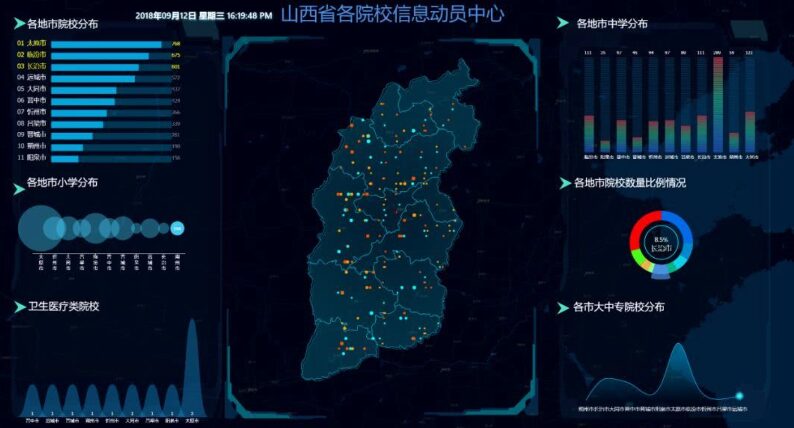

One example is a provincial platform developed by a cloud company building on top of the Tencent platform to deliver a defense mobilization application. The tool readily advertised by Tencent’s cloud business focuses on forming a basic resource library for national defense mobilization in Shanxi Province by integrating various data streams, including provincial military region medical mobilization information, mobilization information of colleges and universities in Shanxi Province, and GIS data on resources like gas stations:

This tool leverages Tencent’s cutting-edge big data technology and advanced algorithms to “actively promote the construction of military-civilian integrated national defense big data and enhancing ‘defense mobilization probability,’ promote ‘deep integration,’ and realize ‘smart mobilization’” for the national defense mobilization system in China.

Tencent’s cloud operation stands to be a pivotal piece in Beijing’s broader approach to the semiconductor competition and RISC-V’s role therein. Regardless of exact next steps, it’s difficult to see that role diverging from the interests of the Chinese government and its military-civil fusion strategy.